Hanypay, a leading Ghanaian fintech licensed by the Africa Diaspora Central Bank (ADCB), proudly announces a strategic agreement to develop and integrate the AKL Lumi stablecoin into the global financial ecosystem. This landmark initiative, structured under the Stablecoin Development, Security Audit, Marketing, and IT Consulting Arrangement, marks a significant step in expanding financial inclusion, digital asset adoption, and economic empowerment across Africa and the global diaspora.

The agreement, referenced under Arrangement Number: 4557/2425/09/03, formalizes a partnership between Client and Bank Group (CBG) and a consortium of industry-leading Group of Consultants (GOC) specializing in blockchain technology, financial auditing, compliance, and fintech innovation. This collaboration will see the AKL stablecoin securely developed, audited, and integrated with international cryptocurrency exchanges, bringing a new level of accessibility, transparency, and financial stability to users worldwide.

Client and Bank Group (CBG) and the Group of Consultants (GOC) Consortium

Client and Bank Group (CBG), in collaboration with a consortium of industry-leading experts under the Group of Consultants (GOC), has successfully formed a strategic alliance spanning the United Arab Emirates, India, and Singapore. This significant milestone marks the culmination of several months of rigorous negotiations, extensive regulatory assessments, stringent compliance reviews, and comprehensive legal structuring.

The establishment of this consortium underscores a shared commitment to fostering innovation, financial excellence, and industry leadership across diverse markets. With expertise drawn from multiple global financial hubs, CBG and GOC aim to drive transformative solutions in banking, fintech, investment strategies, and regulatory compliance.

This partnership positions the consortium as a formidable force in shaping the future of financial services, ensuring seamless cross-border transactions, enhanced regulatory alignment, and the integration of cutting-edge financial technologies. Through this collaboration, CBG and GOC seek to unlock new opportunities, facilitate economic growth, and contribute to the advancement of global financial ecosystems.

Project Scope and Objectives

The project will be executed in three key phases such as Stablecoin Smart Contract Development with the creation of a secure and efficient stablecoin smart contract with robust collateral management, KYC/AML compliance, and blockchain-based transaction verification. Regulatory Audits and Exchange Listings in ensuring compliance across multiple African jurisdictions and facilitating seamless listings on global cryptocurrency exchanges. Finally, Marketing, Public Relations, and Branding in elevating awareness and driving adoption of AKL Lumi through strategic engagement, positioning it as a preferred digital asset for economic transformation.

Hanypay’s integration of AKL Lumi on its platform has already seen a surge in adoption, reinforcing the growing demand for stable digital currencies backed by tangible assets. The agreement underscores the commitment to positioning AKL Lumi as a major player in the stable coins market.

Strengthening Financial Sovereignty and Economic Empowerment

As part of this initiative, Hanypay will ensure seamless transactions through its advanced peer-to-peer (P2P), business-to-business (B2B), consumer-to-consumer (C2C), and government-to-government (G2G) exchange solutions. The platform’s ability to support 170 fiat currencies further cements its role as a leading fintech enabler for global trade and investment.

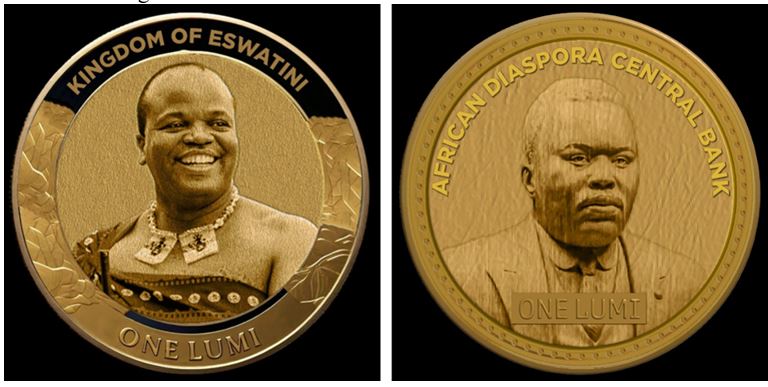

AKL Lumi, launched by the Africa Diaspora Central Bank in June 2024, has rapidly gained traction as a trusted digital currency backed by four grains of 24-karat gold per unit. The current agreement will not only bolster confidence in the Lumi ecosystem but also unlock new investment opportunities for African kingdoms, communities, and the global diaspora family.

About Hanypay

Hanypay is a Ghanaian fintech company licensed by the Africa Diaspora Central Bank (ADCB), offering cutting-edge digital payment solutions, blockchain integration, and cryptocurrency exchange services. With a focus on financial inclusion, Hanypay enables seamless transactions across global markets, empowering businesses, individuals, and governments with secure, efficient, and transparent fintech solutions.

Encouraging Adoption and Future Growth

With a projected timeline of 10 weeks for full implementation, community members and investors are encouraged to purchase and trade AKL Lumi in anticipation of this major milestone. The Hanypay platform will continue to provide seamless conversion, exchange, and transaction capabilities, ensuring that users benefit from the stability and security of the AKL Lumi stable coin. Hanypay remains committed to fostering economic independence, financial empowerment, and digital innovation across Africa and beyond. This agreement represents a crucial step toward creating a sustainable and inclusive financial future for millions.

A New Era for Digital Assets in Africa and the Diaspora

The AKL Lumi community is on the brink of a revolutionary transformation as the world accelerates towards digital assets and currencies. The development of the AKL Lumi stablecoin, in collaboration with Hanypay and the Global Operations Consortium (GOC), marks a significant milestone in financial inclusion for Africa, the Kingdoms, and the global African diaspora. With the stablecoin set to be listed on major decentralized exchange (DEX) platforms, confidence in AKL Lumi trading, buying, and selling is reaching new heights.

Strategic Development and Financial Inclusion

The project, spearheaded by Hanypay, a licensed financial platform under the Africa Diaspora Central Bank, is expected to be completed within ten weeks. This initiative aligns with the broader vision of the Africa Diaspora Central Bank Foreign Exchange, which facilitates seamless currency conversion across the Sixth Region and continental Africa. Through this system, the LUMI will enable frictionless trade transactions, fostering stronger economic ties between Africa and the diaspora.

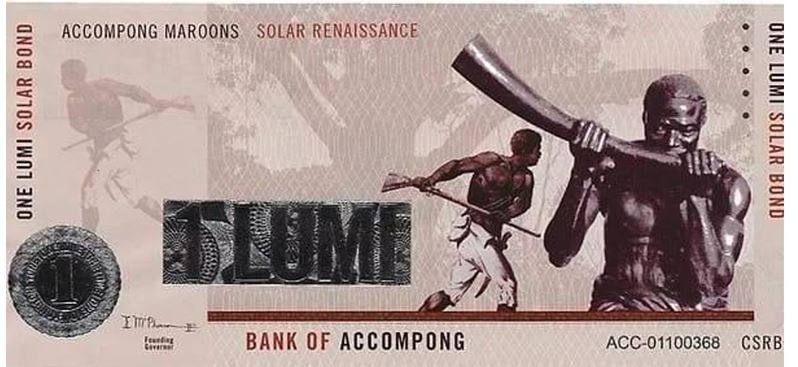

The AKL LUMI: A Historic Leap in Financial Innovation

As the official legal tender of ECO-6, ADCB proudly issues the African Kingdoms LUMI (AKL) a revolutionary currency designed to reshape Africa’s financial future. Each LUMI note is backed by 100kWh of solar energy and pegged to four (4) grains of gold (0.2592g), making it the world’s first clean energy/gold standard currency. The LUMI is uniquely positioned to drive sustainable finance, empower industries, and support economic policies aimed at the collective prosperity of Africa and its global diaspora.

As ECO-6 continues to build economic bridges between Africa and the Diaspora, the establishment of ADCB and the LUMI currency marks a new era of financial independence, stability, and inclusion for all African-descended people worldwide.

The African Diaspora Central Bank: Pioneering Financial Stability

The African Diaspora Central Bank (LEI: 894500ZVOL3A9LO8LP28 of ISO-17442) is a non-political institution operating with the singular mission of strengthening Africa’s economic landscape. By leveraging innovative financial instruments, ADCB is leading efforts to finance industrialization, commerce, and Sustainable Development Goals (SDGs) across continental Africa, the Sixth Region, and among global partners.

Strengthening Diaspora Direct Investment

One of the key objectives of this initiative is to allow fearless capital flow across industries, using the AKL as a stable currency to drive trade and investment between Africa and the diaspora. This initiative will provide an opportunity for individuals and businesses to engage in cross-border transactions without the barriers posed by traditional financial systems.

Reaching the Unbanked and Transforming Lives

Financial inclusion is a core tenet of the AKL Lumi’s mission. By leveraging digital currency, the initiative will provide financial security, transparency, and economic integrity to millions of unbanked individuals across Africa and the diaspora. The LUMI represents a significant step forward in bridging the financial gap and ensuring equitable access to capital for all.

The AKL Lumi: A Currency of Economic Unity

AKL stands for (African Kingdoms Lumi). It was officially adopted on February 16, 2021, to facilitate trade under the African Continental Free Trade Agreement (AfCFTA), which came into effect on January 1, 2021. The AKL Lumi is designed to unify economic transactions within the region and across the African diaspora, reinforcing the vision of economic independence and empowerment.

ECO-6: A Multi-Governmental Treaty Institution

The Economic Community of States, Nations, Territories & Realms of the African Diaspora Sixth Region (ECO-6) is a multi-governmental treaty institution established to enhance economic investments and cooperation between continental Africa and the diaspora. As outlined in Chapter IV, Article 28 (1,2) of the 1991 Abuja Treaty, ECO-6 was ratified on August 1, 2019, as a transformative entity committed to fostering sustainable development and financial autonomy.

The Role of the Africa Diaspora Central Bank Foreign Exchange

The Africa Diaspora Central Bank Foreign Exchange plays a crucial role in ensuring the LUMI’s ability to interface with and convert various currencies across the Sixth Region and continental Africa. This seamless trade transaction capability will strengthen economic unity and empower businesses to engage in cross-border investments with ease.

A Future-Ready Financial Ecosystem

With the introduction of the AKL stablecoin, backed by strategic partnerships and regulatory compliance, the financial landscape for African and diaspora trade is set for a historic transformation. Hanypay has set the pace with its commitment to financial empowerment, ensuring that individuals and businesses alike can now invest in AKL and the AKL stable coin with confidence. The future of digital finance is here, and AKL is leading the way in economic sovereignty and financial inclusion for Africa and beyond.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.