Optimism expressed by businessmen and traders about the stability of the Cedi against the US Dollar in the early part of the New Year, has not been sustained, following the continuous depreciation of the local currency.

The Cedi began the year somewhat on a stable note, but only six weeks into the year, it has suffered a concerning rate of depreciation.

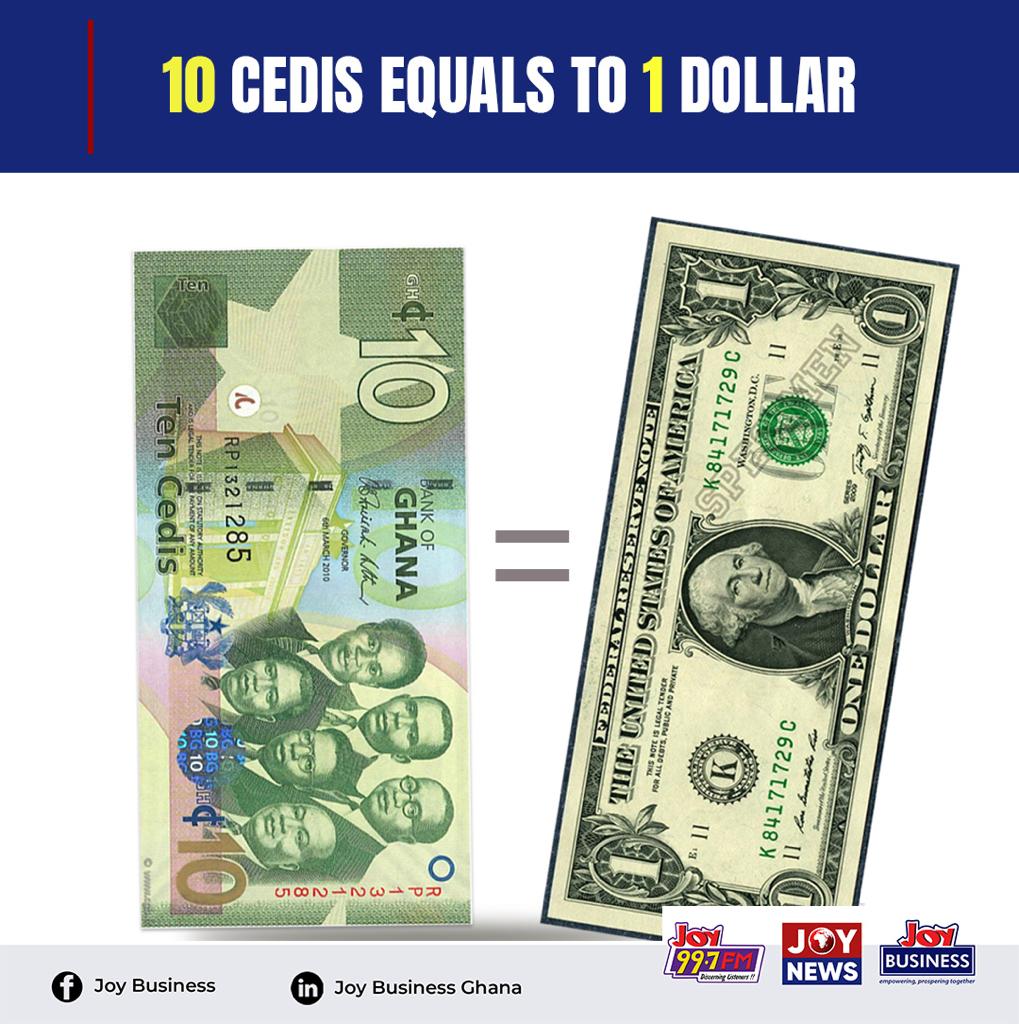

Bank of Ghana data shows that in the first six weeks of the year, the Cedi has recorded a fast depreciation against the U.S. dollar from GHȼ14.5/ dollar at the beginning of January to GHȼ15.55/dollar currently, with higher forex bureau rates.

The fall of the Cedi, within the first six weeks of the year, represents a 6.5% depreciation rate, which has raised concerns.

Analysts have predicted that should this fast rate of depreciation continue to the end of 2025, the cedi would depreciate by over 50% against the U.S. dollar.

Government has therefore, been urged to take immediate measures to check the rapid cedi depreciation before it gets too late.

Meanwhile the depreciation of the Cedi continues to negatively impact fuel prices in the country despite a decline in price on the international market.

Prices of Brent crude and other petroleum products on the international market have dropped by 5.65%, but the fast decline of the Ghanaian Cedi has rather ensured a rise in fuel prices in Ghana.

A recent press release by the Institute for Energy Security (IES), said in the first pricing window of February 2025, the cost of fuel in Ghana surged for the third time this year.

Gasoil price rose by GHȼ0.45 per litre, while Gasoline increased by GHȼ0.24 per litre.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.