Bawku Central Member of Parliament Mahama Ayariga has written a letter to the Governor of the Bank of Ghana (BoG) Dr Ernest Addison on the Domestic Debt Exchange Programme.

Mahama Ayariag believes that the banks will face capitalization and liquidity problems given that they will not receive timely and appropriate coupon payments from their bondholder.

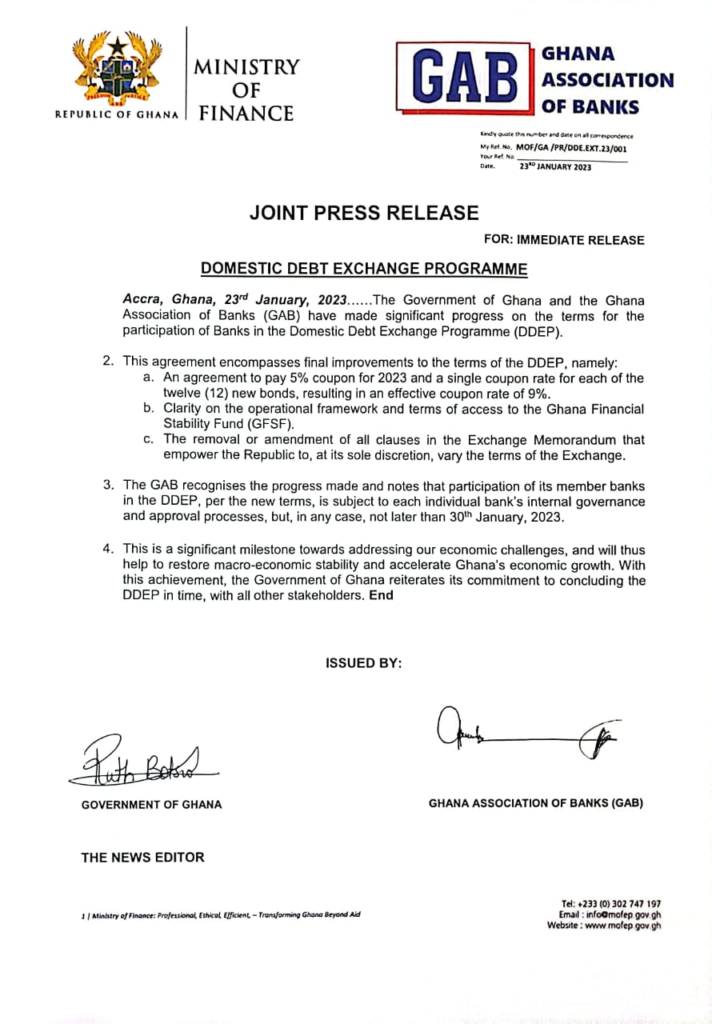

The Government and the Ghana Association of Bankers (GAB) reached an agreement on the new terms for the Domestic Debt Exchange programme.

Earlier, the banks rejected the programme as announced by the government.

The GAB directed commercial banks not to sign onto the amended debt exchange offer over uncertainty surrounding the impact of the debt restructuring on the banking industry.

The association wants its concerns addressed before accepting the debt exchange offer, according to a letter sent to managing directors of banks and seen by 3Business. GAB told member banks that may want to consider the debt exchange in its current form to formally inform the association first before doing so.

“…From the uncertainty surrounding the programme, GAB recommends that all banks must stay any further movement on the exchange until our demands have been met. However, in the event that a bank may have to move forward to exchange, the MD/CEO must inform the CEO of GAB directly of the decision,” according to the letter sent to the banks.”

However, after an engagement with the Ministry of Finance, the Association of Banks that per the new terms, the participation of member banks is subjected to individual bank’s internal governance and approval processes.

“This is a significant milestone towards addressing our economic challenges, and will thus help to restore macro-economic stability and accelerate Ghana’s economic growth.

“With this achievement, the Government of Ghana reiterates its commitment to concluding the DDEP in time with all other stakeholders,” a joint statement from the Finance Ministry and GAB noted.

In his letter to the Governeor of the BoG, Mr Mahama Ayariga said “I contend that the Domestic Debt Exchange Programme will emasculate domestic private banks, as they will face capitalization and liquidity problems given that they will not receive timely and appropriate coupon payments from their bond holder (Government of Ghana).

“I also contend that the directive of the Minister of Finance, to those banks he has so

emasculated, to approach the Ghana Amalgamated Trust Plc (GAT) for support from the Ghana Financial Stability Fund (GFSF) opens them up to a takeover by investors in the GAT, if the Ghana Financial Stability Fund is not wholly publicly funded.

“I further contend that political patronage and nepotism will inform the ultimate purchase of the shares in the private banks once GAT begins to dispose off these shares to realize the investments made in those banks (if GAT is not publicly funded).

“I conclude that the policy and strategic options chosen by the Finance Minister enable the

illegal and unconstitutional expropriation of the private property of the present owners of

domestic private banks and, possibly, private international banks operating in Ghana.”

By Laud Nartey|3news.com|Ghana

Source:

3news.com

Source link