The Government of Ghana and the Ghana Association of Bankers (GAB) have reached an agreement on the new terms for the Domestic Debt Exchange programme.

Earlier, the banks rejected the programme as announced by the government.

The GAB directed commercial banks not to sign onto the amended debt exchange offer over uncertainty surrounding the impact of the debt restructuring on the banking industry.

The association wants its concerns addressed before accepting the debt exchange offer, according to a letter sent to managing directors of banks and seen by 3Business. GAB told member banks that may want to consider the debt exchange in its current form to formally inform the association first before doing so.

“…From the uncertainty surrounding the programme, GAB recommends that all banks must stay any further movement on the exchange until our demands have been met. However, in the event that a bank may have to move forward to exchange, the MD/CEO must inform the CEO of GAB directly of the decision,” according to the letter sent to the banks.”

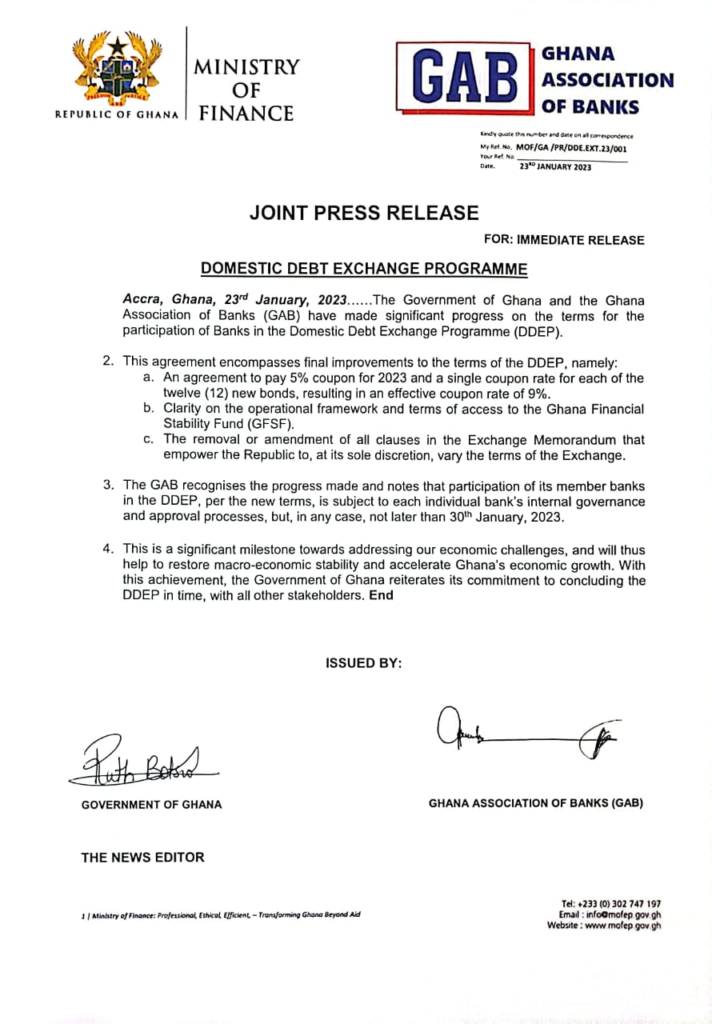

However, after an engagement with the Ministry of Finance, the Association of Banks that per the new terms, the participation of member banks is subjected to individual bank’s internal governance and approval processes.

“This is a significant milestone towards addressing our economic challenges, and will thus help to restore macro-economic stability and accelerate Ghana’s economic growth.

“With this achievement, the Government of Ghana reiterates its commitment to concluding the DDEP in time with all other stakeholders,” a joint statement from the Finance Ministry and GAB noted.

Regarding the new agreement, a Vice President of Imani Africa Mr Bright Simons indicated that still no progress with insurance firms, offshore investment and individuals.

“Still no reason to adjust the earlier forecast that government will get 30% of the liquidity relief envisaged in the provisional IMF agreement.

“So if the government wants speed, it will have to get less debt relief. But this may delay the IMF board approval as fiscal numbs have to be reworked.”

2/

Still no reason to adjust earlier forecast that govt will get 30% of the liquidity relief envisaged in the provisional IMF agrmt.

So: if the govt wants speed, it will have to get less debt relief. But this may delay the IMF board approval as fiscal numbs have to be reworked.— Bright Simons (@BBSimons) January 23, 2023

By Laud Nartey|3news.com|Ghana

Source:

3news.com

Source link